We share hands-on advice for everyday trade and logistics challenges. Access insights and actionable strategies that drive certainty, continuity, and compliance across your operations.

Single Window Initiative (SWI) - Survival Guide for Radiation Emitting Devices

The new SWI landscape The Single Window Initiative means several changes for importers:

Single Window Initiative (SWI): Survival Guide for Health Canada (HC) Blood and Blood Products

The new SWI landscape The Single Window Initiative means several changes for importers:

Single Window Initiative (SWI) - Survival Guide for Nuclear Substances and Equipment

Single Window Initiative (SWI) - A Guide for Nuclear Substances and Equipment The new SWI landscape The Single Window Initiative means several changes for importers:

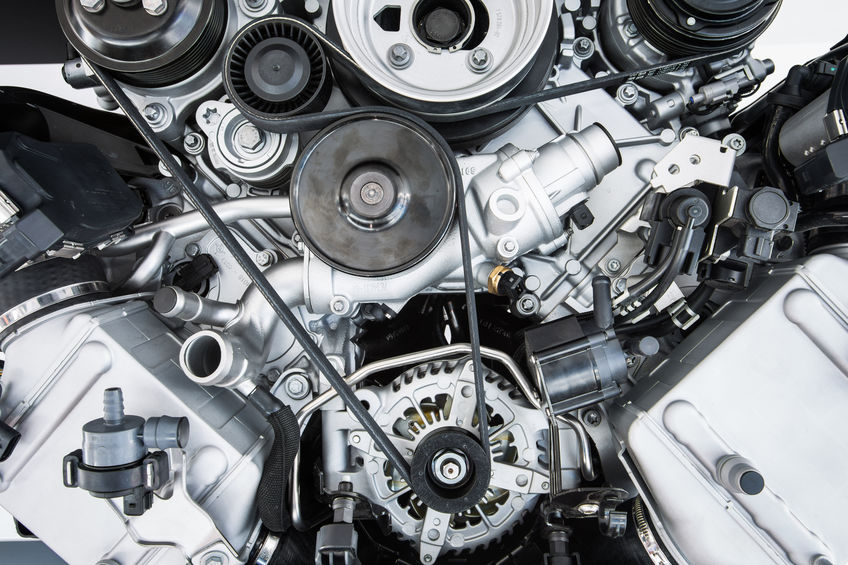

Single Window Initiative (SWI) - Survival Guide for ECCC Vehicle and Engine Emissions Program

The new SWI landscape The Single Window Initiative means several changes for importers:

Single Window Initiative (SWI): Survival Guide for ECCC Wildlife Enforcement

The new SWI landscape The Single Window Initiative means several changes for importers:

Single Window Initiative (SWI): Survival guide for Health Canada Veterinary Drugs

The new SWI landscape The Single Window Initiative means several changes for importers:

Single Window Initiative (SWI): Survival guide for Health Canada (HC) Natural Health Products

The new SWI landscape The Single Window Initiative means several changes for importers:

Single Window Initiative (SWI) - Survival Guide for Fisheries and Oceans Canada (DFO-MPO) Trade Tracking Program

2020.png)

The new SWI landscape The Single Window Initiative means several changes for importers:

Keeping great records: a guide

Maintaining a paper trail of documentation as an importer or exporter is a must. If you are audited, clear and complete records need to be at your fingertips. But, which documents need to be kept? For how long? This week, we offer you a clear guide to keeping great records.

10 Tips for Handling Canadian Customs as an Importer/Exporter

Dealing with Canadian customs as an importer/exporter isn't always easy. The process requires a business to have a deep understanding of several things, such as the duty rates, import fees, the import/export process, and so much more.

Latest Articles

- 7 logistics essentials for agriculture

- Celebrating International Customs Day 2026: Protecting society through vigilance and commitment

- How Canadian importers can adapt to changing customs regulations

- Bi-weekly Freight Updates - January: latest news and updates on the worldwide supply chain

- CBSA Verification Priorities - January 2026